In today’s hyper-competitive financial markets, even a microsecond can define the difference between profit and loss. High-frequency traders rely on extreme speed, precision, and low-latency execution to stay ahead—something only a specialised HFT infrastructure provider can deliver. As markets evolve and algorithmic trading becomes increasingly sophisticated, the backbone supporting these operations has also transformed. Modern High Frequency Trading servers and ultra-low-latency networks now power the world of lightning-fast financial transactions, enabling traders to execute millions of orders within seconds.

Why Speed Is the New Currency in Trading?

Financial markets once moved at a human pace—today, algorithms rule the game. Whether it’s equities, forex, derivatives, or cryptocurrencies, traders compete not only on strategy but also on infrastructure performance. Algorithms scan market data, identify trends, and place trades instantly. Any delay in processing could mean lost opportunities worth millions.

This is where specialised architecture and high-performance computing come in. Every component of an HFT setup—from server hardware to fibre routing—must be optimised to ensure absolute minimal latency. Without this, even the smartest strategy may fail to deliver results.

The Role of an HFT Infrastructure Provider

An HFT infrastructure provider plays a crucial role in designing, deploying, and maintaining trading systems capable of ultra-low-latency execution. These providers understand that high-frequency trading requires more than just powerful hardware. It demands a complete ecosystem engineered for speed, resilience, and accuracy.

Here are the core elements they bring to the table:

1. High Frequency Trading Servers Optimised for Extreme Performance

At the heart of every HFT setup are specialised High Frequency Trading servers. Unlike traditional enterprise servers, these are engineered specifically for speed:

- Overclocked CPUs with low core counts that maximise single-thread performance

- Non-uniform memory access (NUMA) optimisation

- Ultra-fast NVMe storage to prevent I/O bottlenecks

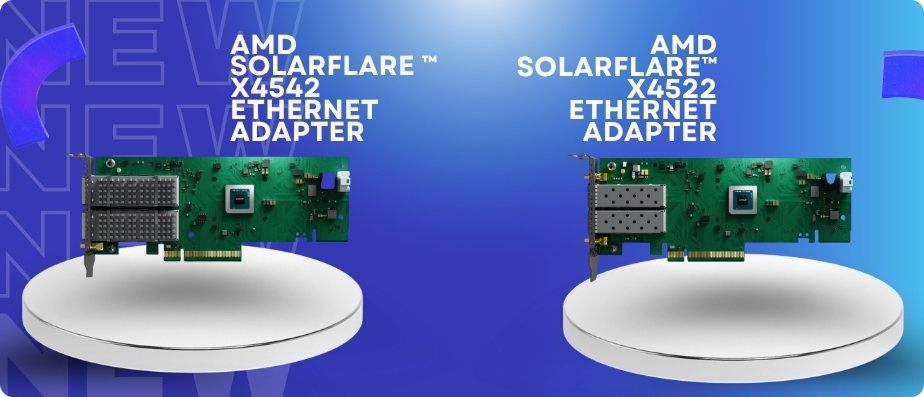

- Purpose-built network cards designed for nanosecond-level packet processing

These servers operate with minimal overhead and maximum precision, ensuring algorithms run at the fastest rates possible.

2. Ultra-Low-Latency Networking

The speed of communication between servers, exchanges, and data centers directly influences trade execution. An experienced HFT infrastructure provider ensures:

- Direct connectivity to exchange colocation centers

- Optimised fiber routes with minimal hops

- Use of microwave or millimeter-wave links for sub-millisecond transmission

- Advanced network-switching technologies with lightning-fast packet forwarding

In the world of HFT, even a 1-millisecond improvement can translate into a strategic advantage.

3. Colocation Services Near Stock Exchanges

Proximity matters. The closer your servers are to the exchange, the faster your orders execute. That’s why most high-frequency trading firms rely on colocation solutions:

- Dedicated rack space inside exchange data centers

- Direct cross-connects for rapid communication

- Managed power and cooling solutions

- Physical proximity reducing latency to microseconds

This geographical advantage is something only professional HFT infrastructure providers can set up efficiently.

4. Powerful Market Data Feeds and Processing Systems

High-frequency trading requires real-time access to market data. Providers ensure:

- Ultra-fast market data feed handlers

- Multicast feed support for major global exchanges

- Low-latency data distribution frameworks

- High-speed processing systems that avoid message drops

Without reliable and instantaneous data, no trading algorithm can perform optimally.

5. Resilient and Redundant Architecture

Speed is worthless without uptime. HFT operations demand robust systems that remain stable even during intense market volatility. Providers offer:

- Redundant networking paths

- Failover servers and backup configurations

- Power redundancy (A+B feeds)

- Continuous health monitoring and performance tuning

This ensures that trading systems never experience downtime that could cause substantial financial loss.

6. Low-Latency Software and Kernel Optimisation

Beyond hardware, software plays a key part in speeding up operations. Expert providers fine-tune:

- Operating systems with customised low-latency kernels

- Interrupt handling optimisation

- TCP/IP stack tuning

- Real-time performance monitoring tools

With everything streamlined, algorithms execute with unmatched precision and speed.

Why Businesses Need a Specialist Instead of DIY Setups?

Setting up HFT infrastructure isn’t like building a standard IT environment. It involves deep technical expertise, high-end hardware, specialised routing, and a precise understanding of financial markets.

A small misconfiguration—like a mismatched cable, improper BIOS setting, or an unoptimised kernel—can slow execution by microseconds. In HFT, that’s enough to wipe out entire profit margins.

Working with a specialist ensures:

- Better performance

- Lower latency

- Higher reliability

- Faster deployment

- Continuous optimisation

- Access to professional-grade facilities

In other words, partnering with an expert is not an optional luxury—it’s a competitive necessity.

Conclusion:

As markets grow more automated and strategies become more complex, the demand for high-speed, reliable infrastructure continues to rise. An experienced HFT infrastructure provider gives businesses the competitive edge they need through cutting-edge architecture, elite High Frequency Trading servers, and ultra-low-latency networking solutions. They enable traders to operate at lightning-fast speeds, seize opportunities instantly, and maintain resilience even during extreme market volatility.

For organisations looking to stay ahead in the fast-moving world of algorithmic trading, partnering with a trusted provider is essential—and SP Sysnet stands ready to power the next generation of high-frequency trading innovation.