High Frequency Trading (HFT) is a world where every microsecond matters. Trades are executed at lightning speed, and even the smallest delay can mean losing out on huge opportunities. At the heart of this ultra-fast trading world are High Frequency Trading servers, specially engineered machines designed to process data faster than a human can blink. These servers are not like standard computers. They are built, optimized, and positioned strategically to reduce latency—the time it takes for data to travel between systems.

In this article, we take a closer look inside HFT servers and explore how they are engineered for microsecond performance. We will also understand how an HFT infrastructure provider plays a key role in enabling this speed-driven environment.

Why Speed Matters in HFT?

In traditional trading, decisions may take seconds or even minutes. But in HFT, algorithms make thousands of trades in fractions of a second. If a server responds 5 microseconds slower than another, the slower system may lose a profitable trade to a faster competitor.

This is why firms invest heavily in:

- Ultra-fast hardware

- Low-latency network connections

- Specialized software and algorithms

- High-performance cooling and power setups

The overall goal is simple—reduce latency to the lowest possible number.

The Engineering Behind High-Frequency Trading Servers

1. Ultra-Fast Processors Built for Low Latency

High-frequency trading servers use specially-tuned CPUs. Instead of focusing on multiple cores, they prioritize:

- High clock speeds

- Low power latency

- Real-time processing

- Reduced background processes

Every millisecond saved in computing translates into faster trading decisions. Many HFT systems even disable standard operating system tasks to avoid interruptions.

2. FPGA Cards for Near-Instant Data Processing

Field-Programmable Gate Arrays (FPGAs) are widely used in HFT systems. These are specialized chips that can process data at hardware speed, much faster than traditional software.

Benefits include:

- Microsecond-level processing

- Lower power consumption

- Ability to handle huge volumes of market data

- Reduced overhead on the CPU

FPGAs are often used for tasks like reading market feeds and pre-processing data before the algorithm decides to trade.

3. High-Speed Memory and Storage

To handle thousands of trades per second, High Frequency Trading servers rely on:

- Low-latency RAM

- NVMe storage

- Memory-optimized architectures

Traditional hard drives are too slow. NVMe drives offer extremely fast read/write speeds, ensuring the trading engine receives data instantly.

Some advanced systems even store entire market books in RAM for instant access.

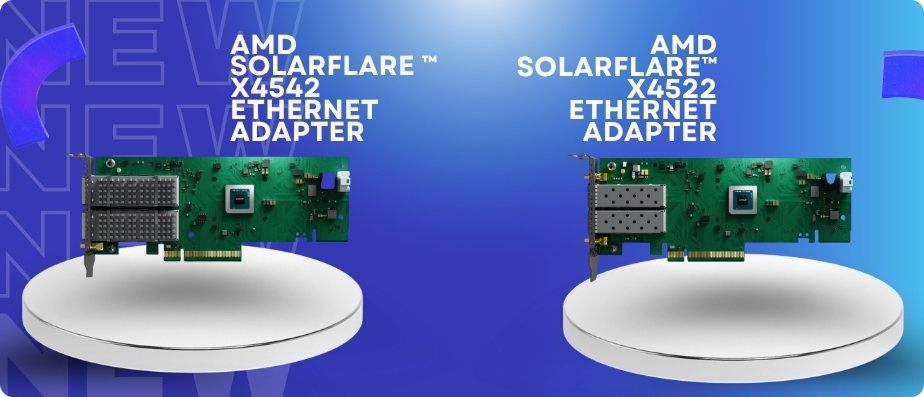

4. Network Cards Designed for Microsecond Performance

Networking is the backbone of HFT. Standard network interfaces are not fast enough, so companies use specialized low-latency network cards that offer:

- Kernel bypass technology

- Hardware timestamping

- High-precision packet handling

- Faster transmission of market order

These cards reduce network delays and ensure the server communicates directly with exchanges with minimal buffering.

5. Precision Time Synchronization

Trading requires accurate time tracking. Even a small error in timestamps can disrupt trading logic or cause regulatory issues.

HFT systems use:

- PTP (Precision Time Protocol)

- GPS-based clocks

- Nanosecond-level timestamping tools

Time accuracy ensures trades are executed in the correct order and market data is processed correctly.

Location Matters: The Power of Colocation

Even the fastest hardware cannot compensate for long physical distances. That is why HFT companies use colocation—placing their High Frequency Trading servers inside or very close to stock exchange data centers.

Benefits of colocation:

- Microsecond-level network latency

- Direct cross-connects to exchanges

- Stable environment with high uptime

- High-speed fiber connections

Being physically close to the exchange reduces the number of hops data must travel, which is crucial for microsecond trading.

Cooling and Power: Keeping Servers at Peak Performance

High-speed systems generate heat. To ensure stable performance, HFT servers require:

- Liquid or advanced air cooling

- Redundant power sources

- Uninterrupted power supply (UPS)

- Environmental monitoring

Even a slight rise in temperature can slow down the CPU, affecting trading performance. Proper cooling ensures every component runs at maximum efficiency.

Software Optimization for Microsecond Speed

Hardware alone cannot deliver ultra-low latency. Software optimization is equally important.

HFT software is designed to:

- Reduce unnecessary code

- Prioritize real-time execution

- Minimize system calls

- Use lightweight kernels

- Handle large datasets efficiently

The goal is to ensure market data is analyzed instantly and orders are pushed out without delay.

Security in HFT Systems

With so much money moving at incredible speeds, security is critical. HFT servers are protected by:

- Firewalls

- Real-time monitoring

- Secure communication protocols

- Hardware-level encryption

Role of an HFT Infrastructure Provider

Setting up an HFT system is highly complex and expensive. This is why many trading firms rely on an HFT infrastructure provider. These providers offer:

- Low-latency server hosting

- Colocation services

- Specialized hardware setup

- Optimized networking

- 24/7 monitoring and support

They help trading companies achieve microsecond-level performance without building everything from scratch.

Conclusion

High-frequency trading is a world driven by speed, precision, and advanced engineering. High-frequency trading servers are built with specialized hardware, optimized networks, and low-latency configurations to operate at microsecond levels. From FPGA cards to colocation and precision timing, every element works together to reduce delays and boost performance.

For trading companies looking to enter or scale in the HFT space, working with an experienced HFT infrastructure provider ensures they stay competitive in this fast-moving environment. And when choosing a trusted partner for these high-performance systems, SP Sysnet stands out as a reliable name offering advanced solutions for today’s trading demands.